☕️ Palantir v SAP, my two cents

Mar 27, 2025Howdy! 👋

The markets are up this morning after an initial run to the downside to clean out the weak money.

Why?

It’s the same story we’ve been talking about for weeks.

Smart investors are already buying shares in companies they know will come through this stronger on the other side when tariffs go away, are mitigated or just plain get taken off the table.

It’s an important reminder of something I call “Keith’s Rule of the Back Page.”

Most investors sadly and predictably make their move when the news breaks but the problem with that is “everybody” knows it’s happening. The biggest, best and potentially most profitable stories are almost always found on the “back page” where very few people are reading along.

Let that sink in.

Here’s my playbook.

1 – Cars and tariffs, what nobody is talking about... yet

US President Trump just dropped a 25% tariff on all cars not made in the U.S., effective April 2nd, with collections starting the very next day. $100B in expected revenue. (Read)

Predictably, the majors are getting smoked—Ford, GM, Stellantis, Ferrari, BMW, Mercedes, VW, Toyota, Honda, Hyundai. Even Tesla got dinged thanks to overseas parts.

But here’s what nobody is talking about.

Every moderately-aged piston clanker in decent shape just got a whole lot more valuable—regardless of where it’s made.

That spells opportunity for O’Reilly’s (ORLY), Genuine Parts Co (via GPC), and dang near every shop keeping beaters alive.

Banks with heavy car loan exposure could get clipped as buyers rethink payments they didn’t understand in the first place – but I digress.

Hyundai and VW will likely argue U.S. investment = tariff break.

There’s gold in this mess… I just haven’t found the motherlode yet – pun absolutely intended.

Trade idea: Punters may want to start a nibble on ORLY or GPC but I urge investors and the OBA Family to stick with the big dogs and far bigger profit potential.

Hmmm. 🤔

2 – Still waiting for AI to monetize? That ship’s already sailed

I hear it all the time— “I’ll invest when AI starts monetizing.” 🤦

Reality check… OpenAI is projecting $12.7B in 2025—that’s more than 3X last year’s $3.7B. (Read)

Not monetizing?

Puuuullllllleeeeeeeaaaasse!

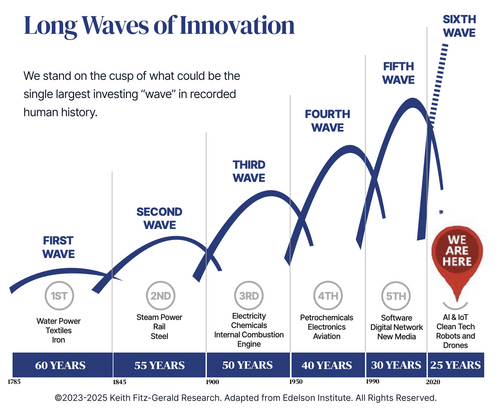

We’re living on the edge of the 6th Wave—a shift so massive that it’s rewriting human history. Every business on the planet will adopt, adapt, or die.

Keith’s Investing Tip: You and your money are just begging to get left behind if you are not taking this into consideration as you invest. I’ll be here if you need me.

3 – Pop, then a drop as expected

I suggested a quick trade yesterday to play Gamestop’s pop then a drop. (See #4).

Shares are down this morning which means there’s a very good possibility that you’re grinning.

GameStop is valued at $12.7B or what will be at least 2X the cash balance after the latest round of convertible debt. MicroStrategy, on the other hand, is valued at less than 2X the value of its bitcoin holdings according to Wedbush analyst Michael Pachter as reported by CNBC. (Read)

Indeed.

I believe GameStop is very unlikely to make it for much longer, but that’s just me – and not for nothing, I could be completely wrong. So, there is that.

4 – Palantir v SAP

SAP recently became Germany’s most valuable company (Read) and scores of investors are thinking to themselves how great that is. I don’t disagree, btw.

What catches my attention is something we’ve talked about before.

The real battle isn’t data or antiquated code stacks.

It’s about data ontology.

Big companies using SAP (and other similar enterprise software) cannot rip it out or migrate away from it without a great deal of money, headache and heart burn.

So what they’re likely to do instead is box it off using what’s called an abstraction layer – meaning a new tool set that gives ‘em more control, better data management, operations, and data flow.

And guess who owns that space?

Palantir.

I’d rather bet on where the world is going than where it’s been any day of the week.

You?

5 – Why Nvidia showed up early to CoreWeave’s party

News just broke that Nvidia’s backing CoreWeave’s IPO at $40/share and committing to buy $250M worth when it goes public. (Read)

Why would Jensen Huang & Co. do that?

Coupla reasons:

- CoreWeave runs heavy on Nvidia GPUs—especially for AI.

- Nvidia’s $250M isn’t charity. It’s a bet CoreWeave’s worth every penny.

- Anchoring an IPO is like anchoring a mall—remember those??!!!—and Nvidia’s the Nordstrom.

Put another way and in plain English… the cool kids just showed up to the party early and dropped a fat tip. Everyone else will follow.

Not sure who’s bringing the keg, but whatever.

I’m inclined to stick with Nvidia (NVDA) or buy the dip because there is no doubt in my mind that the big money will try to mess with headlines and the IPO narrative.

And if you’re thinking about snapping up a few CoreWeave shares?

Be careful.

IPOs are as rigged as it gets in today’s markets—prices can soar just as easily as they can faceplant.

Bottom Line

Always do what Wall Street does, not what it says!

Knowing how the game is played is a huge advantage because it means you can sidestep the chaos and use it to your advantage.

Profit potential almost always follows.

As always, let’s MAKE it a great day.

You got this – I promise!

Keith 😀