☕️ Log off. Think straight. Profit more.

Mar 21, 2025Howdy! 👋

There’s not a lot going on in the markets that we haven’t already talked about, so I thought we’d change things up a skosh.

Millions of investors are struggling because they can’t think clearly, not because there isn’t a ton of profit potential out there.

I see it every day.

Yet, you know the rule if you’ve been reading my work for any length of time whatsoever…

Chaos always produces opportunity and the more of the former there is, the more of the latter you have!

But how do you get there? – to the profits, I mean.

Like many things in the investing world, the answer is counter intuitive.

And, not for nothing, deceptively simple.

Log off. Think straight. Profit more.

That’s the goal, right?

But let’s be honest—between the doomscrolling, hot takes, and social media “experts” furus and pundits yelling over each other, many investors are drowning in noise and starving for clarity.

Case in point and not long ago, I watched a seasoned investor panic-sell a perfectly solid stock—after it dropped 8% on nothing but a headline from a verified account that turned out to be AI-generated nonsense.

No research. No earnings miss. Just a tweet, a trigger, and a 10-second decision they regretted for months.

They’re not alone.

Think back to the 2022 tech wreck, for instance. A bunch of folks dumped big names like Meta and Nvidia at the bottom, convinced by the social media mob that “tech is dead” and “AI is a fad.”

Fast-forward to today—Meta’s up nearly 400% from those lows. Nvidia? It didn’t just rebound; it rewrote market history. Palantir, same deal. Both have returned 864.68% and 973.20% respectively even after all the recent selling.

It’s the same old story.

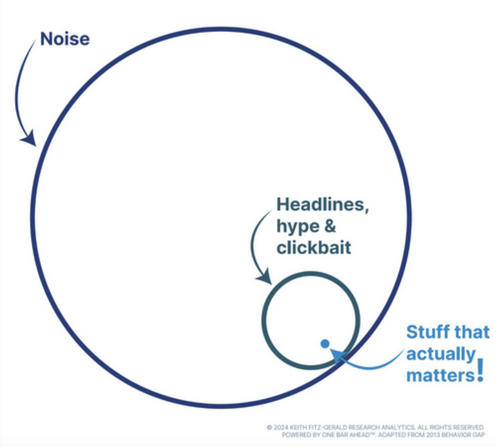

The keyboard warriors got trapped into a cycle of smaller and smaller bits of information which meant they lost larger and larger bits of focus.

Those who tuned out the noise, stuck to the plan? They won and, in many cases, big.

You want to make better decisions. Smarter trades. Real progress.

But your brain’s stuck buffering because you’ve got 47 opinions, 12 alerts, 16 cups of coffee and a dopamine loop working against you.

It’s not your fault.

The system is built to hijack your attention.

You’ve been led to believe that smaller and smaller bits of information are what you want to focus on—every tick, every tweet, every whisper from some influencer with a chart and a ring light.

And Wall Street loves that.

Why?

Because while you’re glued to your screen watching the 5-minute chart, they’re carving up the markets into nanoseconds and running high-frequency trading algorithms that can buy, sell, and hedge positions faster than you can blink.

It’s not trading anymore—it’s programming.

Firms spend millions to place servers closer to the exchanges, just to shave off microseconds of latency. They’re not making decisions in real time—they’re running simulations in advance, executing at scale, and using your emotional reaction as fuel.

Here’s the punchline:

The more distracted and reactive you are… the more predictable you become.

And predictable behavior is easy money for algorithms trained to exploit it.

So every time you chase a headline, overtrade a dip, or let social media shake you out of a good stock, guess who’s on the other side of that trade?

Not a person.

Very likely a machine that never sleeps, never scrolls, and doesn’t care about your feelings.

That’s why detoxing your inputs is not optional—it’s a competitive investing edge.

Specifically, a digital detox—specifically designed for investors.

One that helps you cut the static, think clearly, and make moves that actually build wealth.

Here’s mine and I hope it helps.

Step 1: Audit the Noise

Start by identifying where the mental static is coming from.

That means taking a hard look at your digital inputs:

- Who are you following on Twitter/X, YouTube, or TikTok?

- What newsletters hit your inbox each morning?

- How often do you check your brokerage app... be honest?

Many investors confuse activity with productivity. But constantly checking prices or listening to conflicting hot takes doesn’t make you more informed—it makes you more reactive.

So here’s your task:

Pick one day and write down everything you consume related to the markets—every headline, post, ping, and portfolio check.

Chances are, most of it isn’t helpful.

Some of it may even be actively harmful.

Once you see it on paper, the path forward gets clearer.

Invest in optimism rather than cowering in fear.

Step 2: Set Strategic Boundaries

Now that you’ve audited the noise, it’s time to build a filter.

Ask yourself:

“What content actually helps me make better decisions?”

Keep that. Ditch the rest.

Here’s a practical way to create structure:

Timebox your screen time: Set 15-30 minute windows each day to check the news, updates, or alerts. Outside those windows, turn off notifications.

Unfollow freely: If someone’s content makes you anxious, doubtful, or frantic—even if they’re “smart”—cut the cord.

And if somebody’s being an unmitigated jackass towards you, shed ‘em – life is too short to tolerate that kind of toxicity.

One trusted source per category: One macro. One market. One mindset. That’s it.

Your edge as an investor doesn’t come from speed—it comes from clarity.

From seeing what others miss because they’re too distracted to notice.

Step 3: Replace the Feed with Focus

The hardest part of any detox isn’t just what you cut. It’s what you replace it with.

You’ve got a blank space now. Fill it with things that sharpen your edge:

- Read a book that stretches your thinking.

- Revisit your investment plan. Update your assumptions.

- Take a walk and don’t bring your phone.

- Still want your dopamine hit? Fine. Just switch sources. Use tools where the data is curated, the noise filtered, and the focus is always on what matters.

Because here’s the truth.

Focus is the new alpha and attention—your attention—is the most underpriced asset in the market.

The way I see it

Digital detoxing isn’t about going off-grid.

It’s about taking back your most valuable asset as an investor—your ability to think clearly and act decisively.

Cut the noise.

Regain control.

And position yourself to profit when others are still stuck scrolling.

You in?

Bottom Line

Invest in yourself, your portfolio will thank you! 😀 💯

As always, let’s MAKE it a great day and finish the week strong!

You got this – I promise!

Keith 😀